We receive many questions regarding what our recent inclusion in the Forrester Wave™: Commerce Specialists Service Providers, Q4 2018 means for our clients, especially related to receiving the highest score for strategy of any provider in the report and the highest score possible for advisory and consulting. To illustrate that, a recent engagement with a national B2B distributor provides key takeaways for creating practical ecommerce strategies including a digital vision statement, compelling business case, and creating a practical roadmap containing recommendations for projects, technology vendors, skills, timing, and investments.

Background

A leading distributor of engineered materials was seeking to sustain high organic growth – fueled by industry-leading expertise, ability to deploy capital to maintain inventory, and a high-performance sales team with a mastery of relationship selling – despite downward price pressure in global commodity markets. The executive leadership team recognized the opportunity to use digital solutions to better engage with customers, refresh the brand, differentiate, and become the preferred supplier sales channel. The executive leadership team was ready to commit multiple days to address the strategic opportunity to radically transform the go-to-market strategy using digital solutions. The distributor needed a partner with a deep understanding of complex B2B considerations, including an average order size of a semi-trailer, global brokering of orders to suppliers, radically different buying needs of customer segments, and constraints of global commodity prices.

Approaching Strategy without Predetermined Outcomes

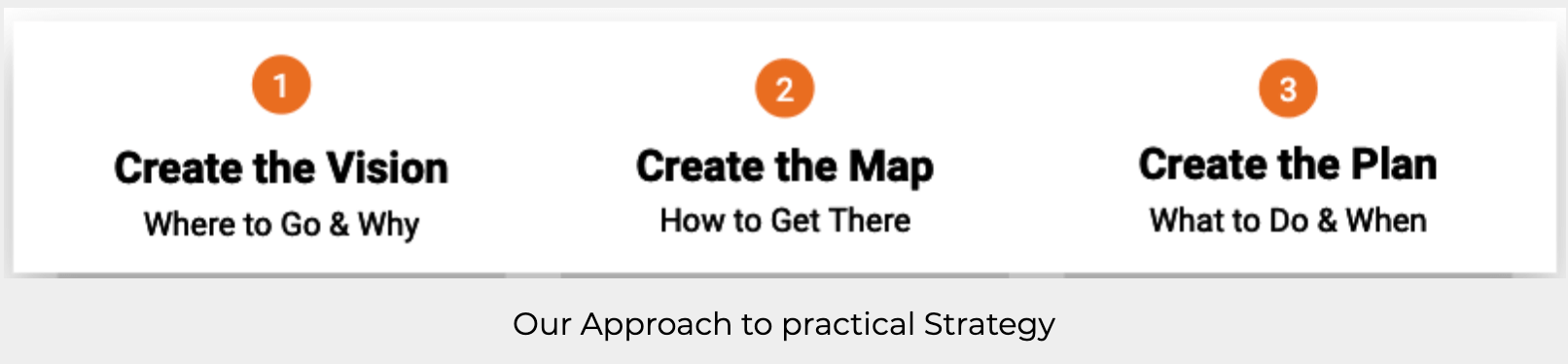

We conducted in-person workshops in 3 distinct phases over 4 weeks to create a compelling strategic vision and challenging but realistic goals, resulting in a prioritized, outcome-based roadmap.

We take great care to not guide our clients to a predetermined outcome to implement ecommerce, and we apply a technology agnostic approach to our strategic recommendations.

The objective was to define a vision and determine meaningful business goals. We kickstarted the conversation by providing viewpoints that ecommerce is more than a buy button, B2B ecommerce does not need to emulate B2C ecommerce, and the journey to ecommerce can start within the sales organization, rather than online transactional selling. Our viewpoints were supported by research from the World Economic Forum, industry analysts, think tanks, and our own insights working with leading and emerging B2B brands. We provided perspectives about the importance of ecommerce and product information management (PIM) for manufacturers and the relative digital maturity of competitors. As the conversation shifted to needs and how to define success, we help define key performance indicators (KPIs), value propositions, and competitive advantages.

Ruthless prioritization of desired capabilities against the manufacturer’s digital maturity produced a group of potential initiatives categorized into quick wins and long-term investments. The team challenged assumptions, and the executive leadership team considered line manager concerns. Many potential initiatives were deferred based on business value.

KEY TAKEAWAY: Identifying and validating the business value of digital initiatives throughout the strategy process is distinctly different than focusing on requirements gathering and feature identification.

If business value drivers are identified exclusively and exhaustively, each requirement can be mapped to business value. The first workshop ultimately produced a compelling vision for the digital channel and guiding principles for the long-term digital program based on brand strength, channel diversity, sales team expertise, and role-based solutions.

The second workshop’s objective served to define capabilities required to achieve the vision and business goals. We provided recommendations to pursue key initiatives based on the potential business value identified during the initial workshop. The recommendations were framed within the complex B2B buying journey from both buyer and seller perspectives. A lively conversation regarding quick wins vs. long-term investment further clarified the required ecommerce capabilities and improved alignment among marketing, sales, finance, and supply chain leaders.

Quoting for customers and the sales team was a key topic. A real concern was user adoption in a customer segment that has time-sensitive buying needs and cannot wait even a day for a quote. For the sales team, the top of mind concern was spending time spent on data entry to produce a quote rather than spending time selling to customers. The sales team wanted the last touch with the customer before the purchase decision. We shared several examples of methods we have used to encourage customer and sales team adoption including roadshows, personalized 1:1 customer training, and c-suite executives performing the same day to day digital activities expected of the sales team. Our guidance was that technology could be applied to any situation, but the organization needs emotional intelligence, leadership, and a grassroots belief in the digital vision to operate outside of their comfort zone.

KEY TAKEAWAY: Peter Drucker’s quote that “culture eats strategy for breakfast” is true in every organization. Recognizing and addressing cultural norms and providing a clear path to the desired cultural state are key components to a successful strategy. We committed to creating multiple proofs-of-concept that could be tested to address adoption concerns.

The objectives of the third workshop included finalizing roadmap initiatives and team alignment. We provided an articulated business case, recommendations for organizational change, and recommendations for over a dozen initiatives spanning digital marketing, quoting, ecommerce, data and analytics, and user adoption. The business case was positioned to the sales team as an incentive for digital sales. The recommendations for organizational change could unlock the value of hidden data and reduce silos between sales and marketing. A commitment from sales to share more quoting data with the marketing team was paired with a commitment from marketing to work with sales to define marketing messages and cadence during the sales cycle.

To make quoting tangible to the sales team – and to show how compelling experiences are data-driven – we presented a proof-of-concept for voice quoting. This used Google Assistant to query ERP data and then generate an email quote using a customer-specific price list. Sales executives were excited about the possibility of generating an accurate quote instantly while driving to their next customer.

Operations executives envisioned better forecasting of supplier purchases related to quote activity. The marketing team would have access to more quote data for use in marketing automation. Customers would have nearly instant access to quotes in both email and a customer portal. The CEO now had a rallying point for his team. As the conversation progressed to next steps, the team was aligned to take action on data, digital marketing, quoting, and commerce.

KEY TAKEAWAY: Roadmaps need to be practical for all stakeholders – financial, organizational, and technology. Simply building a roadmap of features will not deliver the business value required for complex B2B sellers or the compelling experience required by B2B buyers.

Recommendations for Manufacturers and Distributors

- Use partners with deep experience in B2B business models and hands-on experience in delivering successful B2B ecommerce across channels. They should understand complex go-to-market models using direct sales, distribution, marketplaces, and referrals. They should implement and operate digital businesses that rely on our strategies. They should partner with clients to drive adoption from the boardroom to the factory floor to the end customer and everywhere in between.

- Leadership must be actively engaged during digital strategy creation. The presence of C-Level executives and senior leadership for each workshop is a clear signal to an organization that change is occurring. The presence of mid-level managers provides line leaders with access to the thinking of executives. Executives must create an environment where it’s okay to ask and receive hard questions. The combination of executive presence and access can be inspiring, refreshing, and empowering.

- Roadmaps must include initiatives that take advantage of brand differentiators and address the challenges that technology alone cannot solve. Every roadmap needs initiatives to address user adoption and change management. Consensus-driven initiatives early on enables the team to achieve quick wins and build support for subsequent initiatives. Executives are often surprised that the question of “what do you need?” is answered with a request for cultural change rather than an appeal for budget, headcount, or technology.

- Be technology agnostic when defining strategy, and be mindful that implementing technology is not a business outcome. Do not be constrained by a technology stack unless the technology is core to the business. Challenge the team to not mention technology providers – even your existing technology – during initial workshops. A clear vision, realistic goals, and a practical path forward are precursors to defining technology needs and features. Understanding where the organization wants to go, its motivations, timing, and investment priorities are much more strategic than identifying the technology. Many times the technology choices will become obvious.

We creates strategies that deliver outsized business results for our customers. Our inclusion in the Forrester Wave™: Commerce Specialists Service Providers, Q4 2018 is external recognition of the value we provide to leading B2B and B2C companies. Our people deliver the results to change businesses and industries.